|

Белогорьев А. М. — Заместитель генерального директора по

научно-организационной работе

(NATURAL GAS EUROPE, 26.02.2014 г.)

Natural

Gas Europe had the pleasure of speaking with Alexey

Belogoryev, Deputy Director of Russia's Institute

of Energy Strategy. He provided insight and analysis

on the major trends and aspects of the natural gas sector.

He detailed the projects at hand and looks ahead with a

special focus on Southeastern European energy environment.

The present-day natural gas market in Europe seems volatile

if we take into consideration several ongoing mega-projects

such as South

Stream, the Southern Corridor (TAP & TANAP),

along with a series of smaller but vital gas interconnectors

and LNG terminals set to be established.

At the same time the EU and Gazprom are

locked in what it seems to be a major legal battle, whilst

recent problems in Ukraine,

a major gas transit country, further complicates EU-Russian

gas relations. Last but not least, mid to long terms trends

such as the discovery of new offshore gas reserves, the

shale gas upsurge and the growing demand of emerging markets

in terms of gas use, are additional issues that were addressed.

“I don’t believe in significant prospects of shale gas production in Europe, at least before 2030”

Can you assess of the major trends ahead for the European and Russian natural gas sectors. Do we have initiatives that can really be classified as 'game changers' in terms of energy security?

Russia and the EU differently understand what the energy security is. For the EU it is, first of all, growth of energy self-sufficiency due to rise of energy efficiency, renewable energy development, unconventional gas production, etc. In this regard, I think, the development of RES will, nevertheless, retain the role of main game changer.

Secondly, it’s diversification of suppliers, of transport routes, antitrust policy, including the Third Energy Package. And only on the third place we can set lower prices. However, according to Russian view, high energy prices are one of the main reasons, why Europe is losing the global competition with the USA. Energy security is too expensive.

In Russia main internal challenge in terms of energy security is growth of operating costs in upstream. This leads to soaring internal prices for natural gas and electricity and reduction of oil and gas export margin.

The main external challenge is decrease in the price competitiveness of Russian energy export carriers, especially carriers of natural gas. I’m sure that these two factors are more challenging for Russian gas export than the Third energy package or current antitrust investigations against Gazprom.

With regards to Southeast Europe, what can a gas pipeline project such as South Stream bring about and how do you view the objections set thus far by the European Union? Do you estimate that the project will be delayed considerably due to these objections?

I guess no one can give now an unambiguous forecast how this situation will end. For Russia the South stream project has sense only if 100% of its capacity will be used for the pumping of Russian gas bypassing Ukraine. Without any doubt it is also necessary for the EU, because Ukraine is an unpredictable transit country with an uncertain political and economic future.

The adverse stance of the EU towards the South stream, in my opinion, is not related to gas industry in general. It is a struggle against the strengthening of the Russian economic position on the Balkans, one of the key elements of which the South stream should become. The EU believes that it has a monopoly on the Balkans. Russia, like Turkey, takes a different view. In any case Russia is not going to abandon South stream, it’s too late.

According to your view how recent developments such as East Med offshore gas discoveries, the gradual entrance of Iran in the global energy market and the shale gas search in Europe, impact the bilateral commercial relations between Russian gas producers and European costumers?

We do not expect anything good from the European gas market. Not only because it’s largely exhausted its growth potential, but because for years we see the painful negative attitude towards Russian gas from the European politicians. In terms of our supplies volumes we are not afraid of competition from new suppliers in European direction because our supplies are already at the bottom or very close to it.

Going back to your question, I don’t believe in significant prospects of shale gas production in Europe, at least before 2030. East Mediterranean recourses are important, but not enough to affect seriously the European gas market. However, Iran is indeed a very serious issue for all gas suppliers to the European market, especially if it begins large-scale deliveries to this market up to 2020. But this is unlikely.

We are not so much concerned about volumes of our export as about a price of future supplies. Revolutionary changes in the pricing until 2025 and even up to 2030 are hardly possible, but prices will be lower than in recent years.

Could it be said that the EU market still remains a priority for Russian gas companies or has the attention shifted due to LNG export ambitions by Russia and the forthcoming establishment of an export pipeline corridor to China?

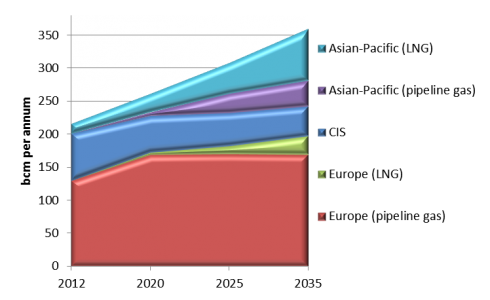

We expect that our export will increase only in Asian-Pacific region (China,

Japan, South Korea, etc.) – figure 1. For us the EU

is, certainly, the most important, but also rapidly aging

market. The only exception is Turkey.

Our priorities are sustainable relations with both new and

old consumers and the highest possible diversification of

export markets. Now the share of the Asia-Pacific in the

Russian gas export is about 7%. We expect to increase it

to 13% by 2020 and to 33% by 2035.

The share of pipeline gas supplies to Europe will fall over the same period from 60% to 42%. Plans for LNG export to Europe are connected with the beginning of exploration of Shtokman field by 2025, but, honestly, Gazprom doesn’t have now clear understanding of its outlet.

Continuing from the previous question, how important is is the SEE market for Russian gas companies, and in particular, Gazprom? Apart from South Stream, are there any other projects that are aimed towards that market?

South stream is the only and, without any doubt, the last Russian pipeline project connected with this region. Except for Turkey, domestic markets there have weak growth prospects; current consumption is also relatively small. So we see no opportunities for significant export growth to the region. But it has a huge transit potential for the transportation of Russian gas to Italy and to the Central Europe and, possibly, of Russian oil to the Mediterranean basin (an ill-starred oil pipeline Burgas-Alexandropoulis).

Besides, Gazprom has great interest in selling gas and electricity produced by gas generation to end consumers. Here opportunities for this are much broader than in most EU countries. Russian gas deliveries to the region closely involve, in Russian understanding, gaining additional margin from its use in thermal power generation as the main consumer.

And, of course, Russian investments in the energy sector of the Balkan countries are the main element of the foreign-economic expansion and foreign-policy cooperation with the regional countries.

What are the most likely scenarios, according to your estimates, for the SEE gas markets in the mid-term (up to 2020) and long-term (up to 2035), based on the indicators at hand?

By 2020 this region will become one of the key gas transport

corridors in Europe due to South Stream, Southern Gas Corridor,

etc. The big question is if an independent and full-fledged

gas hub will arise there, whether in Bulgaria,

Turkey or Serbia,

or not? For the time being it's doubtful. Aggregated gas

consumption of the Balkans countries, excluding Turkey,

will reach about 50 bcm per annum in this period.

Gas will occupy the second place after RES in the consumption growth rate. Noticeable breakthrough in the domestic production of gas, including unconventional gas, is not anticipated. Thus, the share of imports will not decrease, but rather will grow.

The Institute of Energy Strategy is specialized in examining closely and in detail the overall energy policies of the Russian Federation with a distinct focus on natural gas. For a number of years its members have participated in all major energy forums across the world and have conducted far-ranging research for all leading Russian energy players and beyond.

|